Impact of social media on

share prices and liquidity

Scroll to read more

Like many industries disrupted by the internet and social media, the traditional model of investor communication has evolved . Some things have remained the same, such as earnings announcements, trading statements and updates as well as SENS announcements.

In addition to mandatory disclosures, listed entities traditionally engage with investors and analysts through investor days, site visits, management lunches, investor conferences as well as one-on-one meetings. These remain part of a robust investor relations programme.

More recently however, engagement outside the regulated channels has emerged - and gained traction. This includes social media platforms such as Facebook and Twitter, as well as “new kids on the block”, Discord and Reddit. On these platforms, self-professed investors or traders are not shy to share opinion-based “facts”, with little to no verification or fundamental analysis. Some of these vocal “experts” gain large followings and become quite popular (through “likes” and “shares”) and whatever they say almost becomes a self-fulfilling prophecy through the sheer weight of numbers and sentiment.

JSE-listed company targeted by social media

Why did the company become a target?

Company A made several large overseas acquisitions, funded mostly by foreign-currency denominated debt. The acquisitions did not perform as expected, reflected in the downward spiral of the company’s share price. The company found itself in a position where the interest charge exceeded operating profits and debt represented more than 20x the company’s market capitalisation.

The only way out was to sell international assets. However, the lenders did not like the idea and instead offered to recapitalise the business through a debt-for-asset swop. That was the trigger for the activist shareholders to get involved - several of them were retail shareholders of the company and were concerned that it would be “stripped bare”, leaving nothing of value for minority shareholders. A classic David vs Goliath story started to take shape.

The “Twitter war” in a nutshell

Lessons learned and how to prepare for the rise in digital retail investors

This story illustrates how quickly and effectively even a small band of shareholders numbering a few hundred can organise themselves into a meaningful voice that not only has to be acknowledged by company management but could also influence the share price and its tradability.

In the end, the company proceeded with the restructuring process. However, the activist group did exert some pressure on the process and was certainly noticed by management. It is debatable how much the activist group contributed to share price volatility, but anecdotally at least, there seems to have been a reasonable impact.

Corporates and IR managers should therefore:

- Come to terms with the fact that this new retail investor audience is here to stay and is growing in numbers

- Monitor the number of retail investors and consider whether engaging these investors through bespoke retail investor channels is appropriate

- Acknowledge the emergence of social media and non-traditional platforms such as Reddit and Discord - and that these could impact share price volatility and sentiment

- Know what is being said. If the chatter is opinion-based analysis of public disclosures and doesn’t create improper expectations, then there is no need for company engagement. If posts, however, constitute misinformation or undue expectations, an official response may be required. In addition, identify who the influencers are and if outreach is warranted

- Decide on the social media channels you are comfortable engaging on and stick to those.

- GameStop’s recent trading frenzy and headline-worthy price boost should prompt IROs to consider the merits of including social media as part of their IR outreach programme. Failure to do so could be costly in terms of share price volatility, reputation, and management’s time to respond

- LinkedIn is an essential platform for any company looking to showcase itself to investors as well as other stakeholders

- Twitter may be useful to analysts and retail shareholders because of its accessibility – but communication needs to be kept concise and clear. And bear in mind: you need to be prepared to engage on a platform like Twitter (you will be ‘one voice’ among many) or defend your reasons not to engage

- Relevant forums (such as Discord and Reddit) will need to be observed from a distance, but they are not a corporate brand’s domain – and this needs to be respected. Any direct engagement on these channels will attract significant attention and fallouts will need to be managed on the platform itself, which is not ideal

- Simplify messaging as far as possible

- Lofty legalese and corporate speak will no longer cut it if you’re trying to win over an online audience

- Meme-culture (and even content marketing) has changed information sharing – clear data visualisation and simple straightforward graphs and facts are essential and should be repeated across all channels

- Stick to your principles and be sure to communicate in a transparent and consistent manner.

The first mention of a shareholder activist group in the media was on 10 February 2021.At that point very little was known about the group, who they were representing or even who their representative/leader was.

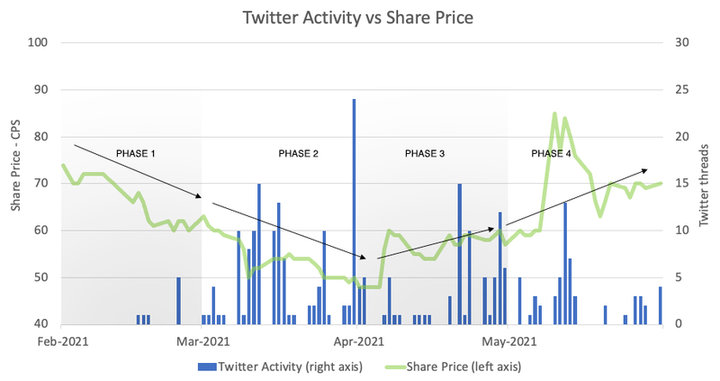

There were several phases to the “Twitter war”, taking place over consecutive months.

Phase 1 (Feb 2021 - Mar 2021)

- Twitter profile created

- Members feel each other out

- Engaging with influencers

Phase 2 (Mar 2021 - Apr 2021)

- Numbers grow, extend to Reddit

- Emergence of a leader/champion

- Reaching out to management

- Share price targets being called out

Phase 3 (Apr 2021 - May 2021)

- Numbers grow, extend to Discord

- Approaching institutional investors

- Calls for "patriotic" buyng by industry's workforce

- List of questions and demands to management

Phase 4 (May 2021 - Jun 2021)

- Some members claiming to make huge purchases, so-called "whales"

- Company announces restructuring details, Twitter group claims victory

- Valuation guesses are made; many times higher than ruling share price

Phase 1 (Feb 2021 - Mar 2021)

- Twitter profile created

- Members feel each other out

- Engaging with influencers

Phase 2 (Mar 2021 - Apr 2021)

- Numbers grow, extend to Reddit

- Emergence of a leader/champion

- Reaching out to management

- Share price targets being called out

Phase 3 (Apr 2021 - May 2021)

- Numbers grow, extend to Discord

- Approaching institutional investors

- Calls for "patriotic" buyng by industry's workforce

- List of questions and demands to management

Phase 4 (May 2021 - Jun 2021)

- Some members claiming to make huge purchases, so-called "whales"

- Company announces restructuring details, Twitter group claims victory

- Valuation guesses are made; many times higher than ruling share price

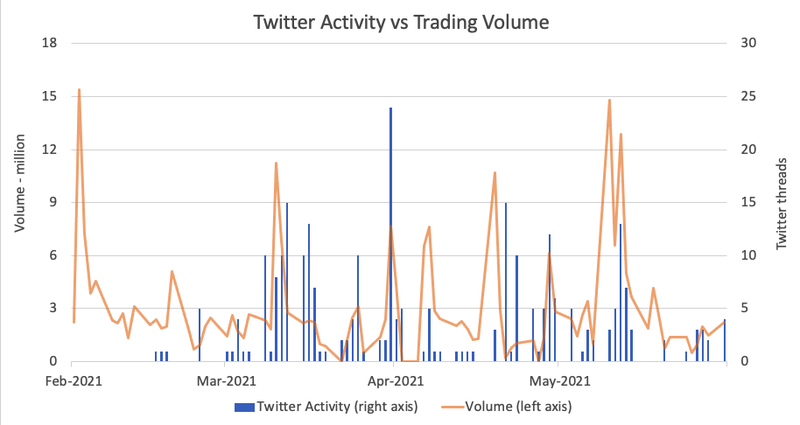

- Twitter activity v share price

While there are occasions where some correlation between Twitter activity and share price movement occurs, it cannot be said definitively that social media activity is the primary share price driver. However, one can safely conclude that it was a large contributor and, on occasion, the primary driver. The impact on volumes seems stronger, as there does seem to be an uncanny, albeit not perfect, relationship between “tweets” and trading volume.

Recently, a JSE-listed company (for purposes of this case study, referred to as Company A) became the topic of much discussion on social media. To the casual observer, it appeared that its share price was more responsive to sentiments expressed on social media than to underlying fundamentals.

One reason for the apparent success of social media in driving the company’s share price could be attributed to the absence of stockbroker research on the company, i.e., no credible, informed sources of company operations, earnings expectations and net asset value, amongst others. Instead, it was set upon by a smattering of faceless people with “handles” instead of names, handing out opinions and “back-of-the-envelope” calculations. These individuals eventually organised themselves into a group of “activist shareholders” mainly on Twitter, but later also on Discord and Reddit. The activist group at some point claimed to represent close to 35% of the company’s shareholder base and started to meaningfully influence opinions about the company and even the direction of its share price.

Contact Nikki Catrakilis-Wagner at Aprio Investor Relations on nikki@aprio.co.za for help with developing a compelling and effective investor relations programme or visit our website on www.aprioir.co.za

Aprio Update August 2021