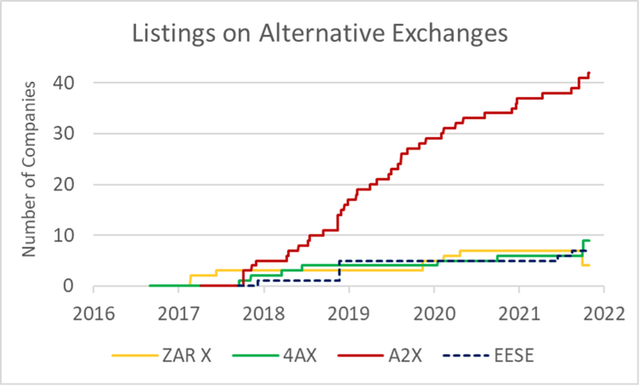

Alternative Stock Exchanges.

The catalyst for a K-shaped economic recovery?

The rationale for companies listing on any exchange is to raise capital while listing on alternative exchanges is mainly based on cost and less onerous listing requirements. Companies that opt for secondary listings do so to provide investors with access to additional trading platforms and their related benefits.

4AX went through a major revival this year, moving operations to Cape Town and re-naming itself the Cape Town Stock Exchange (CTSE). Speed, ease and cost of listing are its competitive advantages, and it will most likely attract pools of capital looking for the same returns.

A2X is primarily a secondary market. In Europe, these platforms are referred to as Multilateral Trading Facilities (MTF). MTFs are well-established and account for 45% of market activity across the world. Similarly, as of October 2021, the market capitalisation of the JSE was at R19.4 trillion (US$1.28 trillion), with A2X’s R5.2 trillion market cap accounting for 27% of that.

Alternative exchanges are a global phenomenon

Established in 1971, Nasdaq rivalled the almost 200-year-old New York Stock Exchange (NYSE) with lower listing fees and cutting-edge technology. As a result, it is now home to technology giants such as Apple, Google, Amazon, and Microsoft. The US currently has 13 registered stock exchanges, including the Chicago Board Options Exchange and the Miami International Securities Exchange.

The UK has its fair share of alternative exchanges, with the best-known being the Alternative Investment Market (AIM), established in 1995 with a focus on smaller companies.

Aprio IR has been asking if the alternative exchanges are the answer to a K-shaped economic recovery in Africa?

A K-shaped recovery occurs when, following a recession, different parts of the economy recover at different rates, times, or magnitudes. This contrasts with an even, uniform recovery across sectors, industries, or groups of people.

In the short-term, South Africa’s macro prospects remain subdued and highly reliant on structural policy reforms. To this end, the landscape for alternative exchanges may be to seek pockets of opportunity, exploit their niches and/or compete on cost or ease of doing business. In the longer-term, provided the structural reforms needed to drive superior and inclusive growth are implemented, alternative stock markets may prove to be the ideal home for small start-ups that will emanate in such an environment.

Some of the exchanges, such as the Cape Town Stock Exchange may already have an advantage as it is targeting a high-tech market, which to some extent is not constrained by general economic or industrial growth and a sub-market in itself.

Exchanges which gain access to the rest of Africa will also have some form of insulation from South Africa’s muted outlook. With capital inflows from these alternative sources, one might even see an unexpected knock-on effect on South African economic growth and the emergence of South Africa’s own version of Nasdaq.

Implications for Investor Relations (IR)

The international example has shown quite clearly that these alternative exchanges can be highly successful. At a minimum, they provide increased competition and choice for corporates and investors alike.

Increased activity is an exciting prospect for the IR function. It elevates the need for strong IR capabilities and presents the perfect training ground for the next generation of IROs.

At the heart of IR is a dialogue. It leads to a mutual understanding between providers and users of capital, resulting in reasonable and informed expectations from investors. Moreover, it brings the long-lasting benefit of building trust between management and investors, allowing both to focus on the long term.

Communicating a compelling investment case, concisely and credibly, supported by a targeted and active programme is vital if companies are to graduate from small cap to large cap status.

NEXT ARTICLE:

How fintechs can build a firm base for expansion across Africa

Do you have a story to tell? Let us help you. Contact Nikki Catrakilis-Wagner at Aprio Investor Relations on nikki@aprio.co.za for help with developing a compelling and effective investor relations programme or visit our website on www.aprioir.co.za

Click to edit...